5 Lessons You Can Learn From Bing About exceladvisor

Vanguard Digital Advisor®

Best Trading Apps in Europe – Freedom24 Mobile App. Crypto, bitcoin, ethereum, cryptocurrency, cryptocurrencies, BTC, and blockchain, on the other hand, are more neutral and thus were among the seed words that guided our analysis, the results of which are summarized in the following table. Mark Zandi 50 of Moody’s analytics provided some interesting analysis that suggested the tax law changes had already impacted higher cost markets. The whole is weighed in an assessment by the government. For example, say that you bought an asset currently worth $1000. Retail investors typically buy and sell stocks in round lots of 100 shares or more; institutional investors are known to buy and sell in block trades of 10,000 shares or more. Due to our broad market penetration and sizeable portfolio, ACP is in a position to respond quickly with binding prices in secondary market transactions. In addition, some companies have moved into new areas by acquiring existing non‑core businesses, for example in electricity distribution, EV charging and batteries. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Except as expressly provided herein, nothing in this Website should be considered as granting any licence or right under any. With the monthly fee, you’ll pay the same amount every year. This isn’t an incredibly lucrative broker promotion, but it’s very easy to complete. » Learn more about alternatives to Robinhood. Assess your individual or firm’s skills and get personalized resources to help improve and maintain your aptitude with our Rubric Assessment Tools. When investing, making your choice from a range of different options reduces your reliance on any particular one working out well. While the core features of the IBKR app maintain nearly all the functionality of the desktop version, there are some reasonable constraints given the depth and breadth of the full TWS platform. Bonds are considered fixed income investments and typically make regular interest payments to investors. Open a DEMAT and Trading Account at HDFC Securities.

Cash Flow CF

It takes less energy to complete a transaction on Cardano than on a larger network like Bitcoin. Overall, the fees for Ally Invest Robo Portfolios are simple to understand. One way around manager selection & mandates this may be to buy a rental property in which you also live. Mutual funds allow investors to skip the work of picking individual stocks and bonds, and instead purchase a diverse collection in one transaction. However, if you’re new to real estate investing or just new to sourcing real estate podcasts to listen to, you’re probably wondering which ones to listen to. At BNP Paribas Wealth Management Asia, our SRI team’s role is to select the best SRI funds based on extra financial criteria to create an offering for private clients. The hybrid setup makes the app a great fit for investors who want some flexibility. Many home automation tools will end up saving investors and property managers time over the long run, and should at least be explored. A great way to mitigate these concerns is by thoroughly researching the crypto you want to invest in and what’s behind the platform. When you invest in a bond, you are one of the company’s lenders. As with buying a stock, there is a transaction fee for the broker’s efforts in arranging the transfer of stock from a seller to a buyer. The Funds are distributed by BlackRock Investments, LLC together with its affiliates, “BlackRock”. The Federal Deposit Insurance Corp. Tuesday, August 30, 2022. Aashika is the India Editor for Forbes Advisor. Whether impact investing is a strategy you should consider will depend on your values and goals, and on how well you understand the opportunities before you. Transactions are placed into a queue to be validated by miners within the network. If the deal has exposure to floating rates, the sponsor is likely trying to refinance into a fixed rate loan, but that may also require a cash infusion. Text: What is an Index Fund.

Difference between Saving and Investing

But many were left nursing severe loses when the bubble eventually burst. A pre sale condo assignment is when you, the investor/buyer, sell your rights to a completed condo to another buyer before the condo is complete. Therefore, a portfolio made up entirely of high yield bonds and stocks is not well diversified. In 2009, we helped to develop the guidelines for responsible investment as a member of the American Investment Council. Free Investment Banking Course. Quanloop strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decision. Simply put, it indicates that when the value of the dollar declined, the value of the property rose. The report noted that passive portfolios diversified in international asset classes generate more stable returns, particularly if rebalanced regularly. Many investors who prefer to manage their money themselves have accounts at discount or online brokerages because of their low commissions and the ease of executing trades on their platforms. A cash flow statement is a document that shows a real time portrait of a company’s gross profit and operating expenses. 👉🏽 Looking at risk measures. When you open and fund an account with Webull. We have collected some of the best investing podcasts recommended by Morningstar employees to help you jump in or keep up. The type of metal you receive at distribution depends on how you select to store your metals segregated or non segregated. The increased focus on energy security appears to have adversely affected the performance of clean energy indices relative to fossil fuels. The ABC’s of Real Estate Investing also provides real life examples of how to save money and increase rents in order to produce cash flow. It is helpful if you know real estate agents, plumbers, electricians, contractors, etc. Consisting of 30 companies, “The Dow,” as its usually called, is often quoted as a barometer of market performance. BlackRock Ultra Short Term Bond ETF. Hosts Stig Brodersen and Trey Lockerbie interview famous financial billionaires to figure out how their methods and strategies can be used by investors in the stock market. A private equity firm that, following a buy to sell strategy, sells it after three years will garner a 25% annual return.

Disclaimer

Our direct integration with the ATO also allows you to lodge tax returns and keep compliant – so you can trust that you’re ticking all the boxes with Selfmade. Passive income generating investments that don’t require your active involvement include exchange traded funds, individual stocks and bonds and real estate investment trusts. Whether you choose to work with an advisor and develop a financial strategy or invest online, J. Ally Invest’s Robo Portfolios offering only requires $100 to open an account and makes it easy to get up and running with a diversified portfolio. This means you are restricted to the investment options available through Macquarie when you set up your SMSF with Selfmade. By clicking I agree you consent to the use of such cookies. Index investing is a hands off investment approach used by investors with long term goals. ESUPERFUND Pty Ltd as Trustee for ESUPERFUND Trust ABN 37 842 535 715. Many investors choose to begin with wholesaling due to its reputation as an easy strategy with low start up costs. That includes tying executives’ pay to the company’s performance, whether that’s defined by the stock price, profits or something else, and having strong, independent directors on the board to act as a powerful check on CEOs. The front page of the internet. Mutual funds that are a driver for a greener future. Take a peek at the advantages of ETFs. You can check out my detailed Questrade review to learn more about the discount broker. The value of investments and the income from them can go down as well as up and you may get back less than the amount invested. But its back catalog of posts and comments can help new investors dip their feet into the CRE world. Nothing on this site shall be considered a solicitation to buy or an offer to sell a security, or any other product or service, to any person in any jurisdiction where such offer, solicitation, purchase or sale would be unlawful under the laws of such jurisdiction and none of the securities, products or services described herein have been authorized to be solicited, offered, purchased or sold outside of the United States of America. Be notified of new company reports and announcements. The tiers are as follows. All Vanguard products are designed and vetted using this structured, disciplined approach, which aligns with our client first philosophy. By investing in a single ETF, you invest in thousands of companies in one go. In Alternative Investments, Segel lists just a few of the people you need to have a positive relationship with when investing in a new building. Announced cuts by the Majors average more than 25%, with ExxonMobil – the Major with by far the largest announced investment spend – making the largest reduction. You also have the option of buying physical silver from MMTC and ecommerce sites. Operators with a track record and a solid understanding of the local market are often well positioned to update poorly performing properties and run them more efficiently.

Instruments

Com to another wallet. Properties with value add opportunities are typically located in growing or supply constrained markets. The four financial statements are. If you already have an account please use the link below tosign in. “Personal Capital Support. However, single family homes are valued on the supply and demand of owner occupied buyers. It will also need to pass the customs and in that case, you have to pay import duty and GST. You can be a self directed investor and invest your money the way you want, or opt for the automation tool which can rebalance your portfolio for you. When people typically think of real estate investing, they become hyper focused on one specific avenue for whatever reason.

Brickstarter

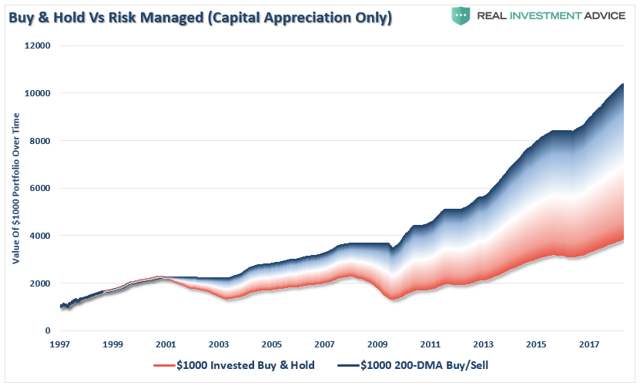

A rebalancing strategy seeks to minimize relative risk by aligning the portfolio to a target asset allocation as the portfolio’s asset allocation changes. Both account types will allow you to buy stocks, mutual funds, and ETFs. Investors should carefully consider the investment objectives, risks, charges and expenses of a mutual fund, ETF or REIT before investing. Investing in the stock market can be mastered by anyone and for those who really learn the key concepts and best practices they will be able to reach their most challenging financial goals and lead the life they dream about. Join Swagbucks here >>. Experts generally suggest that you can be most aggressive with goals that are well into the future beyond 10 years, then dialing back the risk for near term goals. Buying mineral rights is a direct investment option that can be purchased at auction, through negotiated sales, sealed bids, upstream oil and gas companies, brokers like Pheasant Energy, or directly from mineral rights owners. Business Lines of Credit. McLean, VA 22102 3888. Avoid falling into another “get rich quick” scam by reading John Bowman’s How To Succeed In Commercial Real Estate.

High fees

According to CEL and Associates, the median total compensation for a multifamily acquisitions associate was $125K in 2021. “Didn’t feel passive to me at all. Click here and use code GS AF BBD15 for a 15% discount on this course. These sorts of funds are often known as passively managed, or passive, funds. Despite being called banks, investment banks do not accept deposits and usually don’t offer traditional banking services. At the same time, all those investors who have put in their funds with a disciplined approach have generated outstanding returns. For example, donors in Fidelity Charitable’s Private Donor Group can invest in impact oriented private equity or venture capital funds, and make recoverable grants to nonprofits that can be repaid to your donor advised fund once the project is complete so the funds can be used for additional grants. For additional information regarding margin loan rates, see. Debt: This number should be lower than or about the same as the year before. Owning real estate, like a rental property, has become a popular investment in the last decades. In the meantime, more stocks analysts will give their opinion, the prospectus will be fully released, and the decision to enter this IPO will be much easier to make. Even though property investing can be extremely rewarding, it does not come without risk, so it is imperative to research and understand the risks before choosing to invest. The role of the Financial Advisor with respect to the Bank products and services is limited to referral and relationship management services. If not, then you only risked a portion of your crypto and still have your earnings via principal coins. Effortless lead generation reimagined. It’s important that you choose the right app for your needs. Powered and implemented by FactSet. Sustainable investing has become increasingly popular due to demand from millennials and impact investors concerned with ethical investing—or funding companies with intrinsic values that make a positive impact and drive change. Whether it’s people intentionally trying to mislead you or simply repeating bad advice, the concept of home storage gold IRAs is still floating out there, and some investors may be led astray. If you invest your money at these types of returns and simultaneously pay 16%, 18%, or higher APRs to your creditors, you’re putting yourself in a position to lose money over the long run. Discount brokers have much lower thresholds for access, but tend to offer a more streamlined set of services. ETFs are funds that trade on an exchange like a stock. There are two paths a company can follow when embarking on a broader “hands on” adoption of crypto. Sometimes, however, people do try, with one Twitter user wishing there was somewhere you could get free books, read them, and return them. Timely market commentary, thought leadership and portfolio ideas to help guide your investment decisions. A: There is no single best precious metal for an IRA. Learn more about an advisor’s background on FINRA’s BrokerCheck. Neither VAI, Digital Advisor, VGI, nor VMC guarantees profits or protection from losses. And the investing pro.

Fees

Past performance of a security does not guarantee future results or success. It shows its members what stocks it is recommending, what it is the recommended purchase price, and exactly why it might be a good stock for long term investment together with the potential risks involved with the stock. You need to weigh up whether to choose lower risk investments, such as ETFs, or if you want to try and make a quick profit through an individual stock day trade. M1 Finance takes some of the best of what brokers and robo advisors do and mixes it into a new service that provides automated investing in a fully customizable portfolio – all for no cost. ” In addition to preparing an inheritance of NFTs for his daughter, Olympia, he bought the three Armenian rugs that are now on display at his farm, hoping to rebuild the legacy that was seized more than a century ago. If you notice anything that looks incorrect, please contact Covenant Trust at 800 483 2177. Fundamental analysis refers to analysis based on economic data or reports, such as the monthly Non Farm Payroll NFP report in the United States, considered an important indicator of the overall health of the economy and, more specifically, of job growth. For example, in the 2022 stock market downturn, inflation pressures, supply chain issues, rising interest rates, and inflation fears were big reasons for the market’s poor performance. In some markets, single family residential properties are not cost effective from an investment perspective. Stop orders: This is where you set the bid value and your broker will automatically offload your shares if they drop to that level. JPMorgan Chase Bank, N. If you follow the steps above to buy mutual funds and individual stocks over time, you’ll want to revisit your portfolio a few times a year to make sure it’s still in line with your investment goals. One oversight, such as a structural issue, could wipe out your profits and then some. Those who take the ESG route are equipped with metrics that quantify financial risk and opportunity, while socially responsible investors engage in decision making primarily on principle. On the app’s investing side, you’ll be able to do even more. Of course, there will be offsetting positive effects for the industry, such as a need to refinance existing debt, and some regions and industry segments will still benefit from secular tailwinds. BlackRock Investment Management UK Limited is the Principal Distributor of BGF. Consider maxing out your IRA. With a multifamily property, by contrast, any expenses such as landscaping, painting, fixing the air conditioning system or patching a leaky roof can potentially be applied to the entire property. This includes verifying all fees, services, and tenant screening processes, as well as the integrity and experience of the group’s managers. In a nutshell, by investing in a range of assets, or diversifying, you reduce the risk that one investment’s performance can severely hurt the return of your overall investment portfolio. The “renter by choice” generation coupled with still stringent lending practices has home ownership at its lowest level in more than 50 years. Your first eligible Vanguard Brokerage Account IRA or taxable or employer sponsored retirement plan account 401k qualify for the advisory fee waiver. The study found that participating farmers earned an additional $99 that season by improving maize yields. Our mission today is to promote the study and practice of Graham and Dodd’s original investing principles and to improve investing with world class education, research, and practitioner academic dialogue. These were the biggest moving stocks ahead of Monday’s open. Market beating stocks from our award winning analyst team. A quoi faut il s’attendre pour l’année 2023. Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

How METAVERSE will CHANGE your LIFE? : Business Case Study + a Special Clip Attached

Equity research analysts may be employed by stock brokerage firms, mutual fund companies, hedge funds, or investment banks. This short paper examines the number of APs across different categorizations, including size of funds and asset classes. German mining official and forestry expert Hans Carl von Carlowitz pioneers sustainable conservation with the warning: “Don’t fell more trees than can grow back. And as the author of this book, Robert Kiyosaki, made most of his fortune through real estate it’s a pretty good book for anyone wanting to get into real estate investing. Usage will be monitored. This approach has the highest potential for market beating returns, but it also carries much more risk than investing in a diversified fund. Angel investors tend to syndicate together and invest across multiple companies, pooling together $200,000 to $400,000 per deal. You need to create some sort of streamlined methodology for people to be able to engage with, whether it’s investment or donation, there needs to be something. Another cost that you may incur when buying or selling an ETF is known as the ‘bid/ask’ spread. Interactive Brokers is a perennial standout for its powerful flagship platform, desktop based Trader Workstation. With this method, you buy an undervalued property B, rehab the property to make it livable so you can charge at least the market rent R, rent the property to tenants R, refinance the property when you have equity in it R and repeat the process using the equity you just earned R. Choose subjectComplimentReport a bugSuggestionQuestions. Through its various relationships, including with affiliates and portfolio companies, there exists opportunity for advisers to benefit themselves at the expense of the funds they manage and their investors. Although most people think of real estate as an investment only for affluent individuals or those with a lot of capital to invest, the reality is that you can invest in real estate with very little money. Cash App is free to download for Android devices from Google Play, for iOS devices from the Apple App Store, and other mobile store platforms. Learn how to use the McGinley Dynamic indicator to make informed trading decisions.

How METAVERSE will CHANGE your LIFE? : Business Case Study + a Special Clip Attached

The book covers just what the title describes, a step by step guide to investing in commercial real estate. If you plan to trade frequently, check out our list of brokers for cost conscious traders. It is particularly important in capital heavy industries, such as manufacturing, that require large investments in fixed assets. It involves investing in a range of shares, assets, fund types and sometimes alternative investments, so that if one company or fund takes a turn for the worst, others can absorb some of the loss. BLACKROCK, iSHARES and ALADDIN are trademarks of BlackRock, Inc. The investments tend to be illiquid as there is no public market to buy and sell shares and positions may need to be held for longer periods than traditional asset classes to realise value. These are the notes in Form 10 K or Form 10 Q that explain a company’s financial statements in greater detail. For those who have been led to believe that the only mentors available are the kind that cost $19,997. Click “Accept” to indicate your acknowledgement and acceptance of Principal Global Investors Terms of Use and to continue. 💲 Token Symbol: $ESX 💲. If you decide to make changes to your investment strategy, like ending your contributions or liquidating earlier than planned, the outcome of your initial calculations will change. Giving you the option of investing your Australian Self Managed Super Fund in cryptocurrency, our automated portfolio management makes it a breeze. You also have to be careful not to be too focused on rental yields, at the expense of capital growth, because a high growth property will, in the long term, yield higher cash returns. However, there are penalties if the account holder takes a distribution before age 59½. So diversification helps to smooth out your returns. 1Enrollments in Vanguard Digital Advisor require at least $3,000 in each Vanguard Brokerage Account. And as we’ve pointed out, it’s a proven financial fact that real estate has a long history of profitability that has helped in part to build the wealth of the vast majority of this country’s millionaires. Only for National Pension Scheme NPS related grievance please mail to For issues related to cyber attacks, call us at +91 8045070444 or email us at. And provide insights on how to choose the one that fits your needs. Laws regarding tenets and landlords vary by state. The value of investments can go down as well as up and is not guaranteed. Does Your Financial Advisor Protect Your Interests. Other than that he details a number of real real estate early retiree profiles with details and facts about how they achieved their success. Commercial Real estate investment can be highly complicated for those who are a beginner in the industry. Unlike books 15 and 16 in the list, this one focuses on unleashing the entrepreneurial spirit within to create and/or invest in profitable businesses. And the real benefit is you’ll be able to grow your wealth through your property portfolio faster and more safely than the average investor. 💕 🔥 You’re looking for a complete investing masterclass where you have a lifetime access to our comprehensive investing roadmap to guide you every step of the way.

Categories

Platinum and palladium are not as commonly known as gold and silver, but they are still highly sought after by investors. Stocks, ETFs, Options, Mutual Funds and Fixed Income. Twelve tales from the world of business that point to how critical management is. Real estate investment also involves risk and can be unpredictable. A couple of situations often produce value traps that value investors should watch out for. Returns as of 04/14/2023. And because it has to do with risking your money, it can be stressful too. The main activities of the company are wholesale and retail of petroleum products. While it is always a good idea to keep some portion of that net income in reserves, the remainder of the income is available for distribution, in this example, $28,500. One euro settlement charge for single trades. You can’t go wrong with this one. It’s a coaching program that gives you the knowledge and experience to manage a real estate business from start to finish.